EXPLORE POKIE MACHINES

Industry News

Industry News  09. 05. 2024.

09. 05. 2024. Jelena Radisavljevic

Jelena RadisavljevicIn the first quarter of 2024, GiG Media achieved a revenue of €36.2m, surpassing last year’s €28.4m. This report includes the Platform & Sportsbook division and the GiG Media business. Although the split between these divisions has not occurred yet, GiG dedicated much of last year to preparing for it. Consequently, Q1 results encompass the entire business, facilitating year-on-year comparisons.

Despite a decline in Platform & Sportsbook revenue, GiG Media’s substantial growth drove overall revenue to record highs. Chairman Petter Nylander highlighted GiG Media’s upward trajectory since 2019, citing robust cash flow and diversified earnings. Acquisitions like AskGamblers and KaFe Rocks significantly contributed to this expansion.

Chairman Nylander shared updates on GiG’s split since February, separating GiG Media from Platform & Sportsbook. Last month, plans were unveiled to distribute the Platform business to shareholders. Nylander expects the split to conclude in Q3 2024, subject to corporate actions and approvals.

The split aims to optimize growth and effectively leverage each business’s strengths. GiG remains committed to sustainable long-term growth through strategic initiatives like acquisitions and product innovation.

In Q1, GiG Media saw a 52.2% revenue increase to €28.0m, driven by successful acquisitions and new partnerships in Latin America. Despite a seasonal dip in FTDs, innovative marketing technologies led to early successes.

Geographically, revenue surged 82.0% in the Americas, comprising 22.0% of total GiG Media revenue, with growth in established markets like the Nordics and Europe.

Platform & Sportsbook revenue declined 17.0% to €8.3m in Q1. GiG attributes this to the accounting treatment of GiG Enterprise Solution under IFRS, with most of its value recorded in 2023.

Excluding this, revenue increased by 5.0%—eight new brands launched on the platform, signalling accelerated partner onboarding. With 67 live brands and 18 in the pipeline, the GiG Platform spans 35 markets, including pending integrations.

Ahead of the split, GiG reported group revenue, excluding Platform & Sportsbook, at €28.0m, a 52.2% increase. Operating spending rose 39.4%, while depreciation and amortization costs surged 77.8%.

Pre-tax profit doubled to €9.9m. However, including Platform & Sportsbook, losses were €6.2m, impacting net profit at €3.4m, down 41.9%. Adjusted EBITDA improved 66.7%.

2 days ago

2 days ago

1 week ago

1 week ago

2 weeks ago

2 days ago

3 weeks ago

3 weeks ago

2 months ago

5 months ago

Online casino giant Games Global has revealed they have submitted a filing to the United States Securities and Exchange Commission to list their ordinary shares on the New York Stock Exchange.

By Jelena Radisavljevic23. 04. 2024.

Relax Gaming, one of the more resounding names in the iGaming industry, has recently appointed Martin Stålros its new CEO. Before joining Relax Gaming’s team, Martin Stålros was head of poker operations and business development manager at Kindred Group.

By Jelena Radisavljevic23. 04. 2024.

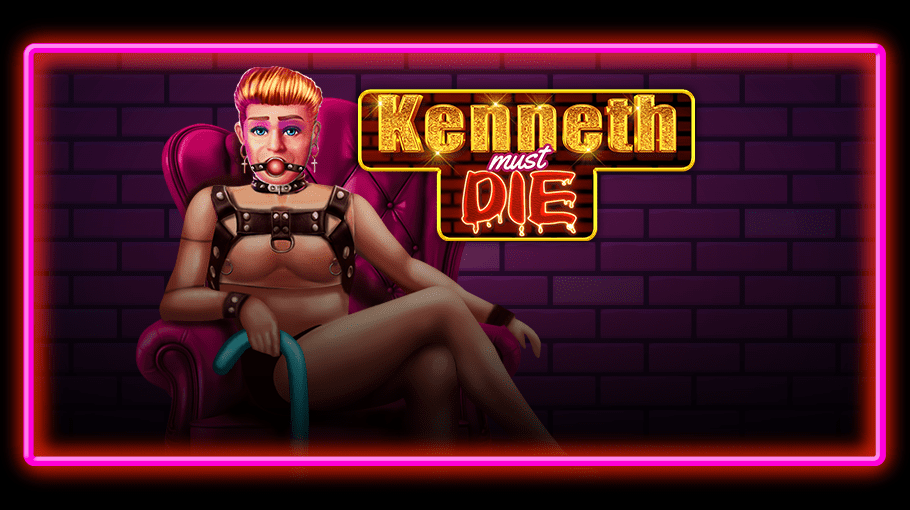

Nolimit City is thrilled to announce the launch of their inaugural NOLIMITTOURNAMENT, offering 500 spins on their latest slot sensation, Kenneth Must Die, to kick off the excitement.

By Jelena Radisavljevic08. 05. 2024.